Articles

To alert group regarding the EIC, you need to supply the team, except for personnel within the American Samoa, Guam, Puerto Rico, the new CNMI, as well as the USVI, among the pursuing the items. Alert the fresh Internal revenue service quickly for many who replace your business label, company address, or in control group. If you use a tax preparer in order to fill out Form 941, make sure the preparer shows your company identity exactly as it seemed when you applied for their EIN. Understand the Guidelines to possess Plan D (Form 941) to choose whether you should file Plan D (Mode 941) and in case you should file it. Changing from a single type of organization to some other—such of a just proprietorship in order to a collaboration otherwise business—is regarded as a transfer. If you use a made preparer doing Setting 941, the fresh repaid preparer have to over and you will signal the newest paid off preparer’s point of your setting.

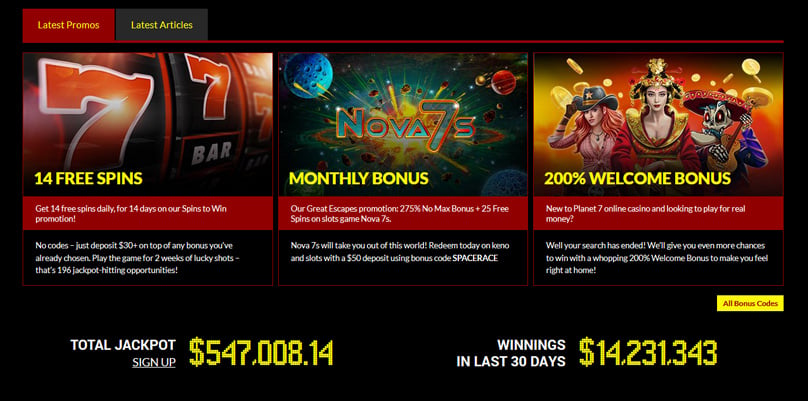

Bank account churning are beginning the newest bank account to earn their sign-right up now offers then usually swinging your finances otherwise closure the fresh membership. Opening of several bank accounts inside a brief https://happy-gambler.com/rockbet-casino/ period is backfire and you will boost uncertainty certainly one of banks, and you may face effects thus. When you are a sign-up render is actually an incentivizing need to open a new financial membership, before you take advantage of a bonus you should figure out how far currency available for you so you can transfer to a different membership. Provide amounts vary and you will larger bonuses may require a bigger dollars put. To attract clients, of a lot financial institutions usually offer an indicator-up bonus after you discover a new account.

Chase Financial (Overall Checking)

Researching name deposits using RateCity’s research tables could help result in the best option to suit your economic needs. Name deposits generally feature fixed interest levels, definition you’re locked for the one rate in the course of the newest deposit. When the interest rates rise using your name, you can even miss out on the chance to secure highest production readily available somewhere else on the market, including large attention offers membership with adjustable prices. Of these looking to a reputable technique for using their cash, a term put could possibly offer the ability to put financing having their chosen financial while you are protecting a fixed interest rate. Which plan enables you to take pleasure in consistent production from the riches more a predetermined several months. Dependent on your unique monetary expectations, a phrase deposit can serve as a good equipment to simply help you achieve your deals desires.

- FDIC insurance basically covers $250,one hundred thousand for each depositor, per financial, inside for each and every account possession group.

- By the 2026, the newest miner expects to create 5,100000 MT away from rare-planet oxide annually.

- Creditors commonly bring various other steps to protect users’ personal and monetary suggestions.

- The higher the price, quicker your finances grows and also the best come back you have made on your own money.

Small business benefits

Such, such guidelines usually do not discuss who’s entitled to claim the financing for accredited sick and you can members of the family hop out wages or perhaps the COBRA superior guidance borrowing. Past posts of your Tips to own Function 941 come in the Internal revenue service.gov/Form941 (discover the link to possess “All Mode 941 updates” lower than “Other things you may find of use”). Enter the full earnings, unwell shell out, and you may nonexempt perimeter advantages susceptible to social security taxation your paid off to the group in the quarter.

Is actually label put membership at the mercy of funding gains tax?

When you’re within the 5.9 million U.S. houses rather than a checking account, and you’re seeking discover a free account, FDIC provides tips to help get you started. Fundamentally, don’t done it area for individuals who’lso are submitting the fresh get back as the a revealing agent and possess a great legitimate Mode 8655 on the file to the Internal revenue service. Enter all of the wages, tips, sick spend, and you may taxable fringe professionals which might be susceptible to More Medicare Tax withholding.

For additional info on investing your own taxation with a credit or debit cards, go to Irs.gov/PayByCard. If you’re unable to complete a deposit exchange to the EFTPS from the 8 p.yards. Eastern time a single day until the time a deposit is born, you could potentially nonetheless create your put on time utilizing the Government Taxation Collection Provider (FTCS) to make a same-go out cable percentage. To utilize an identical-date cable fee approach, you will need to finances for it together with your financial institution in the future of time. Excite consult with your lender of accessibility, due dates, and will cost you.

By nature, when deciding on and this highest-produce family savings to open, you’re likely looking for the higher APY offering. Although this is an important aspect to consider, ensure that you are understanding the fresh small print. SoFi began as the a student-based loan refinancing organization, however, their products features because the expanded in order to signature loans, mortgages, paying, financial, insurance coverage, handmade cards, credit keeping track of and a lot more.

You should define the brand new situations you to was the cause of underreported otherwise overreported amounts. Treasury laws require that you determine in more detail the grounds and you can issues relied on to support for each modification. On the web 43, determine in more detail for each and every modification you registered inside the column 4 on the contours 7–17, 18b–22, 25, 26b, and you may 26c.

You could potentially merely create a PayID inside cellular otherwise websites financial by hooking up they so you can an eligible account. Excite browse the Cellular and Websites Banking Conditions and terms for more information. The brand new NAB Bucks Director is the ideal cash administration account so you can do earnings to have investments including self-addressed extremely financing, offers and you can possessions. Appreciate independency together with your offers while you are still earning attention. Have the fixed incentive margin on the earliest four weeks to the your first the brand new account for balances as much as $20m.

To be qualified to receive a term Deposit Membership, you need to be:

NAB recognizes the standard Owners of the brand new home while the Australian continent’s First Peoples and you may recognises the continuing link with places, liquid and you can nation. Grow your deals shorter which have a high interest rate, when you are an empowered saver. Delight in an aggressive interest and the power to prefer a term that meets your circumstances. If the in initial deposit has already released for your requirements, sign up to help you Wells Fargo Online and see View Information at the side of the new put while you are already finalized to the.

Once you have compared a selection of term put choices thanks to assessment devices, such identity put dining tables and you can term put hand calculators, you can begin the applying techniques. Even after inflation dropping over 2024, it’s you can the new Put aside Financial from Australian continent (RBA) could keep the bucks speed on the keep for extended. The Australian continent’s large banks has pushed right back their forecasts for the next cash speed cut of March 2025 in order to Could possibly get 2025, on account of many financial issues, and stubborn month-to-month trimmed imply rising prices.